How to Deal With LVNV Funding

LVNV Funding is a debt collection agency, which purchases old credit card and loan accounts. In case they contact you, the initial thing is to ensure that you confirm the existence of the debt. Request them to prove the information and you give personal information or pay money. The records maintained by LVNV funding are occasionally incorrect or incomplete since they purchase charged-off debts. Whereas, in case it happens to be, you do owe them, one of the clever things to do is to make an attempt to settle. In this manner, you can only pay less than the total amount and eventually forget the debt.

What Is LVNV Funding?

LVNV Funding LLC is a company that collects debt that is old and has been written off in its creditors and typically as a result of credit card or personal loans. Creditors usually sell their debts at a fraction of the value when individuals are too late to make payments. LVNV Funding purchases a massive bulk of such accounts and subsequently sells them to Resurgent Capital Services, the company who actually collects.

What is LVNV Funding? Why Is It Calling Me?

In case LVNV Funding is calling you, they think you have a debt on a credit card or loan they bought. The debt was initially an obligation of another lender, which is currently possessed by LVNV. Most likely, the one making the phone call or mailing you will be of Resurgent and will be performing the duty of collecting money on behalf of LVNV.

Is LVNV Funding Legit?

Yes, LVNV Funding is an actual debt collection company. They have their headquarters in Greenville, South Carolina and have been accredited by the Better Business Bureau (BBB) since 2017. They even hold an A+ rating. Saying that, the figures also narrate one more story, about 1,000 complaints have been directed to them in the past three years, and numerous others to the Consumer Financial Protection Bureau (CFPB).

The most common complaints that people have reported included:

- Recalling debts which were already paid or not theirs at all.

- Attempt to collect after the statute of limitations had been barred.

- The required sum is far higher than the debt itself.

- Lack of sufficient information to substantiate the debt.

Failure to tell the consumers that they have a right to challenge the debt.

Note: These are actual complaints although not everyone has a similar experience with LVNV Funding. The Fair Debt Collection Practices Act (FDCPA) provides legal enforceability when it comes to abusive, unfair, or deceptive collection practices. LVNV Funding has been sued by consumers on the basis of violating these of their rules. When they or any collector crosses the line, they can file a complaint with the CFPB or even take legal action. Moreover, remember that fraudsters will disguise themselves as authoritative debt collectors. Whenever something does not work, then do not provide personal information. Request in writing evidence of the debt, and make a detailed account of communication.

Step 1: Do I Have To Pay LVNV Funding?

You may have to pay LVNV Funding, however, you must determine whether the debt is legitimate by answering a couple of questions. Does the debt belong to you? Is the amount correct? What are the statute of limitations? The information that debt collectors hold is usually wrong or incomplete and In case the debt does not belong to you, then you can challenge it. In the case that the debt is yours and that it is the correct amount, there are ways to proceed.

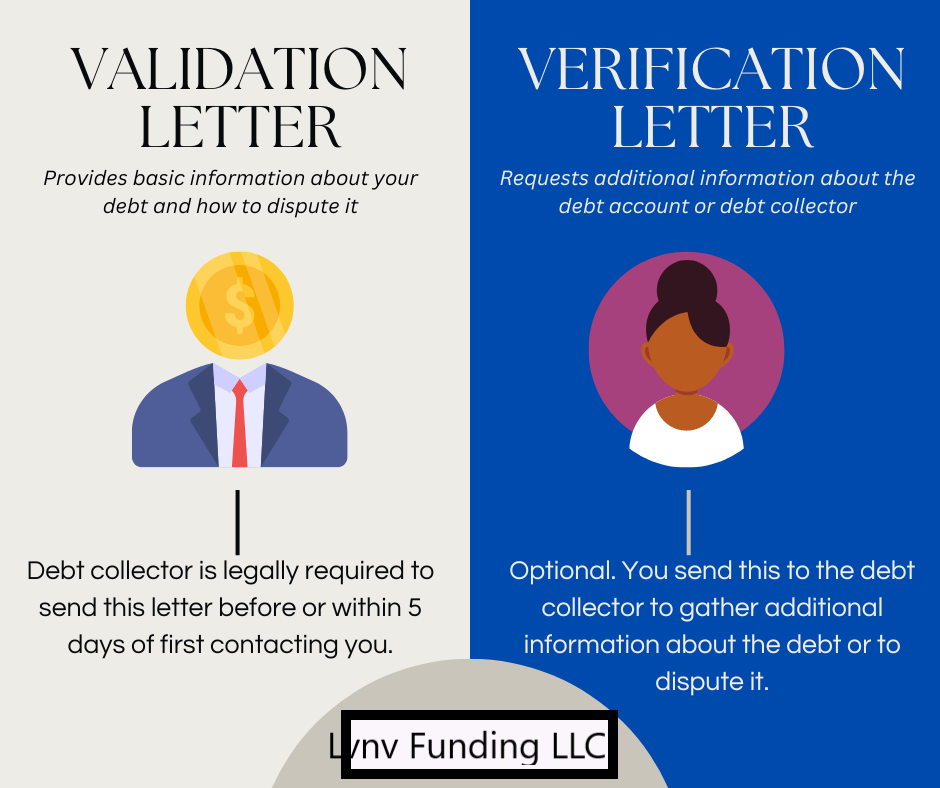

Using a Debt Verification Letter, send a letter to the debtor.

The debt collection rule by the Consumer Financial Protection Bureau (CFPB) regulates debt collectors to give you a validation information upon their first contact with you or within five days since they have been in communication with you. This information will contain the name of the creditor, the amount of money owed at the time and your right to disagree with him within 30 days.

Unless you have already gotten a debt validation letter with LVNV Funding, you can request them to send one or directly send a verification letter. As you are awaiting the verification of the details, you can go ahead and check your credit report. Report any errors!

If LVNV Funding verifies the debt, your next move depends on whether you accept or challenge their claim.

Step 2: Decide Your Next Move

It may seem that handling debt collectors, such as LVNV Funding, is overwhelming, but you are not helpless, there are ways to act. In case you do not concur with their assertion, you will be able to challenge it. Assuming that you agree to it, you can negotiate a settlement. What you must not do is to do nothing at all about it–that just compounds matters in the future.

Option 1: Dispute the Debt

Provided that you get a validation letter by LVNV Funding but the information does not work out, you are entitled to disagree with the notice in writing within a period of 30 days. They are not allowed to proceed with any collection until they have to be satisfactorily verified.

Here is also the best opportunity to examine your credit reports with all three bureaus. In case LVNV provided the wrong information, there are possibilities that your report contains mistakes as well. Fortunately, that happens to be typical- and within the Fair credit reporting Act, you have a 609 dispute letter you can use to dispute the accuracy.

Alternative 2: Negotiate a Settlement

The majority of them are unable to pay the entire amount due- and that is fine. Instead, you can attempt to work out a settlement. Debt buyers such as LVNV will typically accept less than the face value since they are buying the debts at a fraction of a dollar.

Settlements are usually 40 percent to 60 percent of the initial balance. The clever thing to do is to begin low (say 25 per cent 30 per cent) and be willing to go nearer to 50. This provides you with the bargaining space and yet saves you a lot.

Is it possible to negotiate all of the past-due debts?

It depends on the type of debt. Common consumer debts such as credit cards, medical bills, personal loans and payday loans can all be negotiated. Negotiations can also be made of tax debts, and the IRS has its own settlement programs. Conversely, it is not easy to negotiate over mortgages and car loans since the lender can easily take back the property. Federal student loans are also usually not negotiable, but have options to forgive and repayment assistance.

Option 3: No action taken with the Debt (Not Recommended)

It could be tempting to pretend that a debt does not exist and so it would be the easiest way out, yet it is the worst. The debt is not going to go away and neither is the stress.

What will happen when you fail to pay LVNV Funding?

Unless you act on the collection efforts of LVNV Funding, this is what might happen to you:

Damage to credit: Your credit score suffers and you will find it more difficult to be approved of credit cards or loan facilities.

Increased expenses: Fees, interest and even court costs may increase and balance increases.

Lawsuits: You are subject to a lawsuit and in the event of a loss, garnishment of wages or other judgments.

Stress overload: The telephone calls and letters will not cease and the debt that is about to be due could be crushing.

Remember: The negative marks are normally removed off your credit report after seven years but so long as the debt has not yet passed the statute of limitations, collection remains possible.

Bottom Line:

It is a stressful experience to deal with LVNV Funding- or any debt collector- and you do have options. First, you need to educate yourself on your rights. Within a few seconds of reading this, you are already in a better position to assume control and get closure.

Can LVNV Funding Sue Me?

Lawsuits are not the initial step that LVNV Funding takes, and yes–they can sue you. The fact that they actually do depends on a number of factors including:

- State regulations and the manner in which they control debt collection.

- Your state wage garnishment laws.

- The expense of court proceedings and attorney charges in relation to the amount of your debt.

- The number of your present debts (in collections)

- The cost that is due and the value of the cost of a lawsuit.

And should they choose to file a lawsuit, you will most probably be served at home with state court paperwork known as a summons and complaint. This may seem like an imposing task, yet nothing is the worse than not taking action. The non-response may lead to a default judgment, and it is easier that LVNV garnishes your wages or imposes a levy on your bank account.

When you cannot afford yourself to have a lawyer, there are other options. You can also use the services of tools such as Solo-suit to write and submit an answer letter at a low price. They have already helped more than 280,000 individuals to react to lawsuits on debts and even provide a 100% guarantee of money back. Solo-suit is an affiliate partner (Note). You can get a commission in case you use their paid service (this keeps our free resources free).